What Is the UCR Program?

The UCR program funds state motor carrier safety programs and applies to businesses involved in interstate commerce in the United States. Registration is required every year and is enforced by participating states.

Who Is Required to Register for UCR?

You must register for UCR if you operate in interstate commerce and fall into one of the following categories:

-

Motor carriers (for-hire or private)

-

Owner-operators

-

Freight brokers

-

Freight forwarders

-

Leasing companies

If your business has an active USDOT number and crosses state lines (or arranges interstate transportation), UCR registration is likely required.

Who Is NOT Required to Register?

You may be exempt from UCR if:

-

You operate intrastate only (within one state)

-

You have no USDOT number

-

Your vehicles are:

-

Government-owned

-

Used strictly for personal use

-

Operated by certain agricultural or nonprofit entities (in limited cases)

-

Some intrastate carriers are still required to register if their state enforces UCR differently, so verification is important.

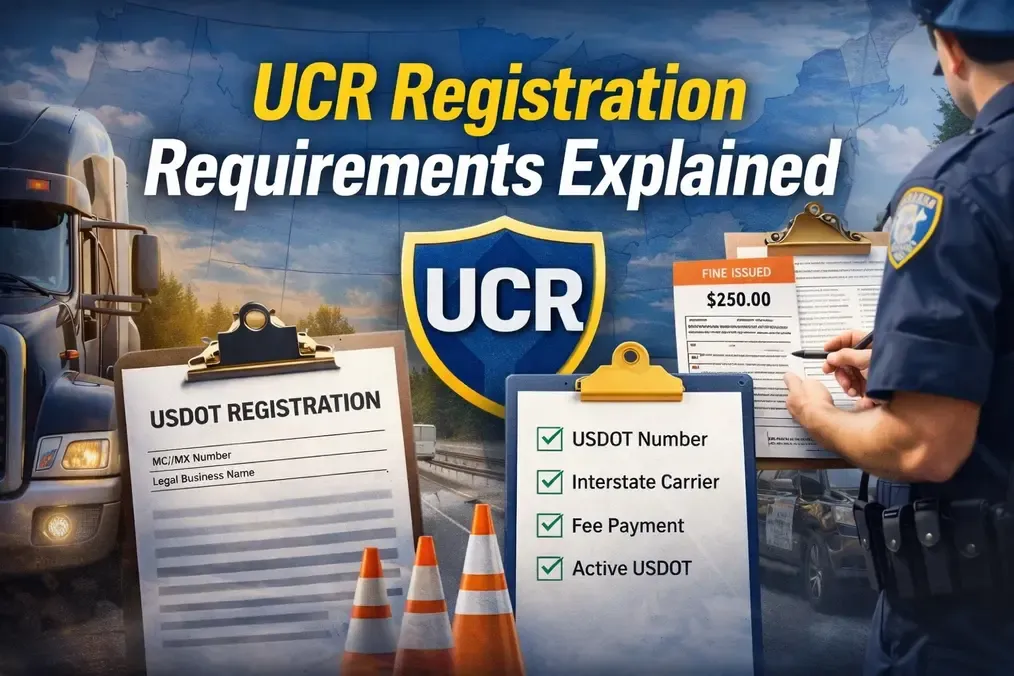

UCR Registration Requirements Checklist

To complete UCR registration, you need:

-

Active USDOT number

-

Legal business name (must match FMCSA records)

-

Business address and contact details

-

Number of commercial motor vehicles operated

-

Valid payment method (credit/debit or ACH)

How UCR Fees Are Determined

UCR fees are based on the number of commercial motor vehicles you operate, not how often you run interstate.

-

0–2 vehicles = lowest fee tier

-

Fees increase with fleet size

-

Brokers and freight forwarders pay a flat fee

(UCR fees change periodically, so always check the current year’s fee table.)

When Is UCR Registration Due?

-

Annual deadline: January 1

-

Late registrations are accepted but may result in penalties or citations

-

Registration covers the calendar year, not 12 months from signup

Proof of UCR Compliance

There is no physical UCR certificate or decal. Compliance is verified electronically by enforcement officers using your USDOT number.

However, it’s recommended to:

-

Keep a copy of your UCR receipt

-

Save confirmation emails for records

Penalties for Not Registering

Failure to comply with UCR requirements can result in:

-

State-issued fines

-

Out-of-service orders

-

Registration blocks in some states

-

Delays during roadside inspections

Penalties vary by state and can be costly if ignored.

UCR vs Other Trucking Registrations

| Program | Purpose |

|---|---|

| UCR | Annual compliance fee for interstate operations |

| USDOT | Company identification number |

| IRP | Vehicle registration for multiple states |

| IFTA | Fuel tax reporting |

| MC Authority | Operating authority for for-hire carriers |

UCR does not replace any of these programs.

Key Takeaway

If you operate in interstate commerce and have a USDOT number, UCR registration is not optional—it’s a required annual compliance item. Staying registered protects your business from fines and enforcement issues.