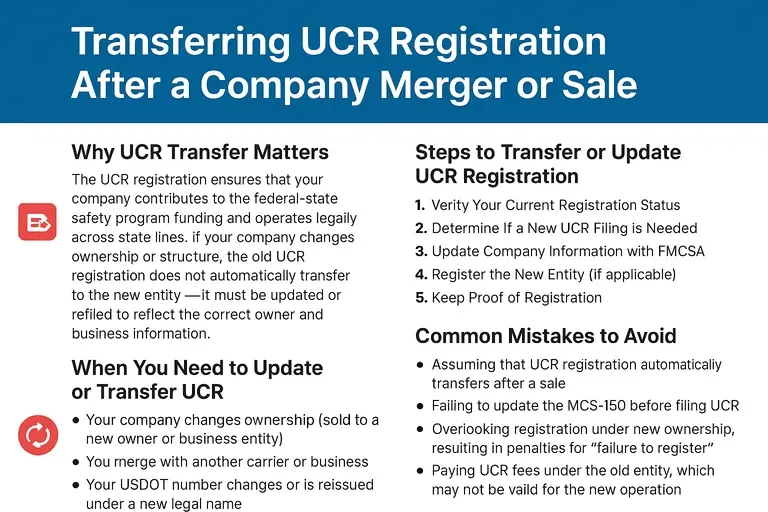

Why UCR Transfer Matters

The UCR registration ensures that your company contributes to the federal-state safety program funding and operates legally across state lines. If your company changes ownership or structure, the old UCR registration does not automatically transfer to the new entity — it must be updated or refiled to reflect the correct owner and business information.

When You Need to Update or Transfer UCR

You must update or re-register your UCR if:

-

Your company changes ownership (sold to a new owner or business entity)

-

You merge with another carrier or business

-

Your USDOT number changes or is reissued under a new legal name

-

You change business structure, such as from a sole proprietorship to an LLC or corporation

In most cases, the new owner or entity must file a new UCR registration under their business name and USDOT number.

Steps to Transfer or Update UCR Registration

-

Verify Your Current Registration Status

Visit https://www.fmcsa.me/ to check the current registration and payment status. -

Determine if a New UCR Filing Is Needed

-

If your USDOT number remains the same and only contact details changed, you may just need to update information.

-

If your USDOT number or company entity changed, you must complete a new UCR registration.

-

-

Update Company Information with FMCSA

Update your MCS-150 form through the FMCSA website to ensure your company details match your UCR filing. -

Register the New Entity (if applicable)

Go to the UCR registration portal and file under the new business name and DOT number. Pay the applicable fees based on fleet size. -

Keep Proof of Registration

Print or download your UCR confirmation. Law enforcement officers may request proof of valid registration during roadside inspections.

Common Mistakes to Avoid

-

Assuming that UCR registration automatically transfers after a sale

-

Failing to update the MCS-150 before filing UCR

-

Overlooking registration under new ownership, resulting in penalties for “failure to register”

-

Paying UCR fees under the old entity, which may not be valid for the new operation

Penalties for Non-Compliance

Failure to transfer or register under the new entity can result in fines, operational delays, or out-of-service orders. Penalties vary by state but can range from $100 to several thousand dollars per vehicle.

Key Takeaway

Whenever your trucking company’s ownership or structure changes, remember that UCR compliance must follow suit. Always review your registration at https://www.fmcsa.me/, confirm your business details with FMCSA, and file a new UCR registration when needed. Staying compliant ensures uninterrupted operations and helps avoid costly enforcement actions.