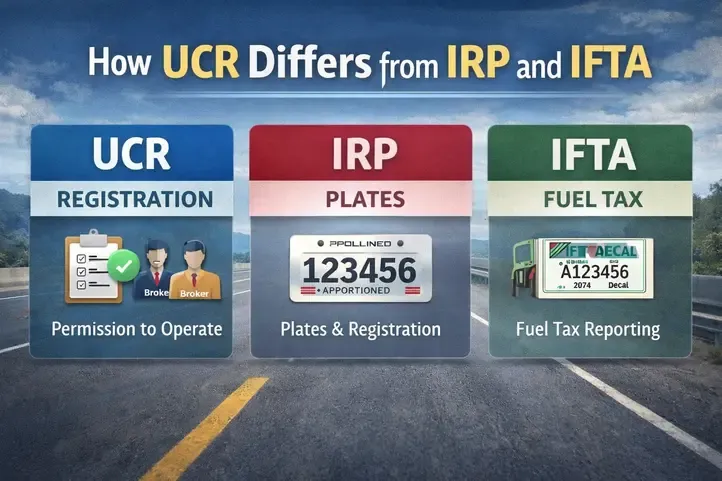

UCR (Unified Carrier Registration)

Purpose: Regulatory registration

Who it applies to:

-

Interstate motor carriers

-

Freight brokers

-

Freight forwarders

-

Leasing companies

Key points:

-

Annual registration based on fleet size

-

No plates, decals, or mileage reporting

-

Required even if you operate only occasionally in interstate commerce

-

Funds state enforcement and safety programs

Think of UCR as a permission-to-operate registration, not a tax or plate program.

IRP (International Registration Plan)

Purpose: Vehicle registration & plate apportionment

Who it applies to:

-

Interstate carriers with vehicles over 26,000 lbs GVW

-

Vehicles with 3+ axles, regardless of weight

Key points:

-

Provides apportioned license plates

-

Fees are divided among states based on miles driven

-

Requires annual renewal and mileage records

-

Does not apply to brokers

IRP determines where and how your truck is plated.

IFTA (International Fuel Tax Agreement)

Purpose: Fuel tax reporting

Who it applies to:

-

Interstate carriers operating qualified motor vehicles

Key points:

-

Quarterly fuel tax reporting

-

Tracks fuel purchased vs miles driven in each state

-

Issues IFTA decals for vehicles

-

Ensures fuel taxes are fairly distributed among states

IFTA controls fuel tax compliance, not registration.

Side-by-Side Comparison

| Program | Main Purpose | Applies To | Reporting Required | Plates/Decals |

|---|---|---|---|---|

| UCR | Regulatory registration | Carriers, brokers | No | No |

| IRP | Vehicle registration | Carriers only | Annual mileage | Apportioned plates |

| IFTA | Fuel tax reporting | Carriers only | Quarterly fuel reports | Fuel decals |

Common Misconceptions

-

“I have IRP, so I don’t need UCR” → Incorrect

-

“Brokers don’t need UCR” → Incorrect

-

“IFTA covers registration” → Incorrect

Each program is separate and mandatory if you meet the criteria.

Final Takeaway

If you operate interstate:

-

UCR = authority-based compliance

-

IRP = registration & plates

-

IFTA = fuel taxes

Most interstate carriers need all three, while brokers usually need UCR only.